Introduction:

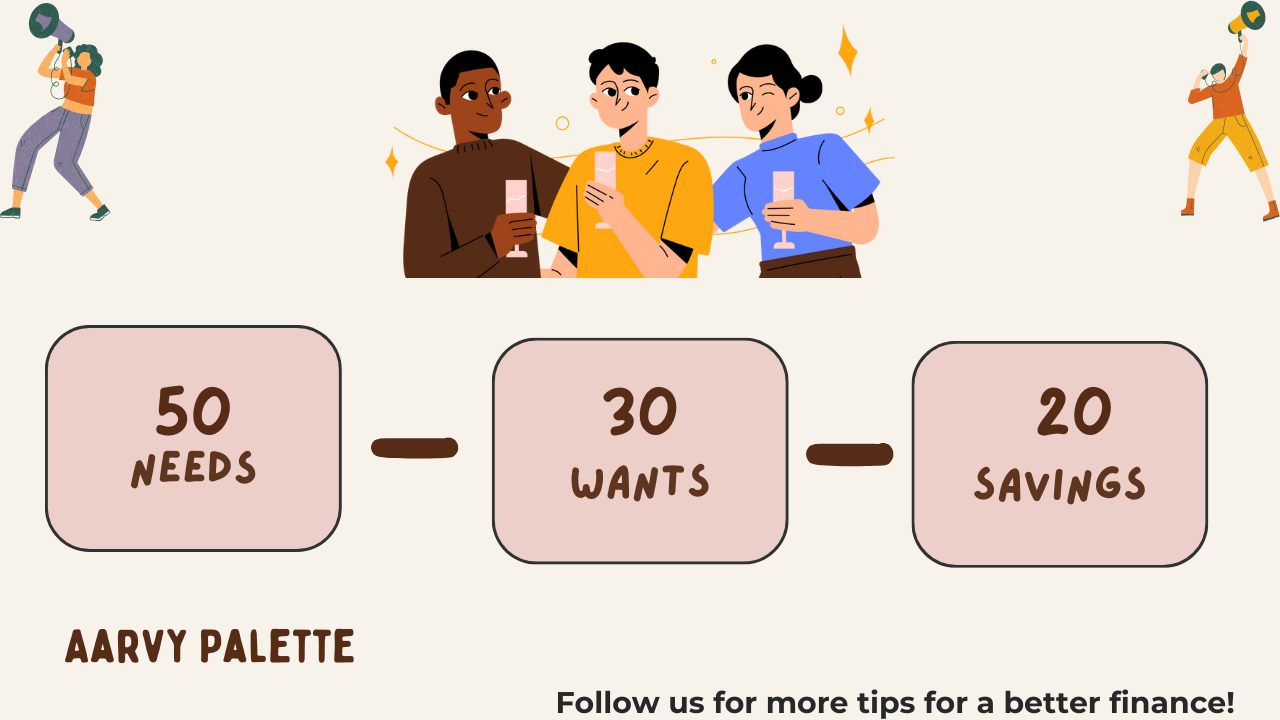

The 50/30/20 rule is a budgeting framework that helps people manage their finances effectively, thereby preventing overspending. It categorizes their after-taxes into three parts:

- Needs: 50% of your income should go towards needs, such as housing, food, transportation, and utilities. These are expenses that you should spend in order to survive in this world.

- Wants: 30% of your income should go towards wants, such as entertainment, dining out, and shopping. You can choose to spend money on these expenses, but it’s not mandatory to spend them.

- Savings and debt repayment: 20% of your income should definitely go to savings and debt repayment. You will keep some money aside for the future, such as retirement, a down payment on a house, or an emergency fund.

How the 50/30/20 Rule Works:

The 50/30/20 rule is a simple and easy-to-follow budgeting framework. It can help you get a hand on your spending and ensure you’re not overspending but saving for the future.

To use the 50/30/20 rule, simply divide your after-tax earnings into three parts: needs, wants, and savings and debt repayment. Then, set your earnings accordingly.

For example, if you earn $3,000 per month after taxes, you would allocate your income as follows:

- Needs: $1,500

- Wants: $900

- Savings and debt repayment: $600

The 50/30/20 rule is a simple and effective way to manage money. It's not a perfect system, but it's a good starting point for anyone who wants to get their finances in order.

Andrea Woroch Tweet

The Benefits of Using the 50/30/20 Rule:

The 50/30/20 rule has many pros, including:

- Helps in reducing your debt.

- You can save for your future goals.

- Improves your financial health.

- Reduces stress and anxiety about money.

Tips for Using the 50/30/20 Rule:

Here are some tips for using the 50/30/20 rule:

- Keep track of your spending for a month to see where your money is going. This will help you identify areas where you need to cut back on overspending.

- Set realistic goals for your savings and debt repayment. Don’t try to save too much too soon, or you’ll be more likely to give up.

- Make a budget and stick to it. This may seem difficult initially, but it will get easier with time.

- Be flexible. Things happen, and your budget may need to change. Be prepared to adjust your budget as needed.

Is the 50/30/20 Rule Right for You?

The 50/30/20 rule is a great starting point for budgeting. However, it’s important to remember that it’s just a guideline. What works for one person may only work for one person. The most important thing is to find a budgeting framework that works for you and stick to it.

Conclusion:

I hope this blog post helps you understand the 50/30/20 rule and how it can help you manage your money.

Follow Aarvy Palette for more Personal Finance and Finance Tips for a better life! You can also check out our other blogs on health and skincare. Follow us on all social media platforms to have daily updates!

Like this page ? share it with your friends !

- All

- Beauty & Fashion

- Finance

- Health

- Personal Finance

Amazon Diwali Mobile Offer 2023: Best Deals on 10 Popular Phones, Compared and Contrasted

Different ways to MAKE money from home

5 High-Intensity Interval Training (HIIT) Workouts for a Total Body Burn:

Nipah Virus in India: 10 Things You Need to Know to Stay Safe

Mystery Behind MS Dhoni’s Long Hair Revival for IPL 2024 : For Fans or Farewell?

The Best Summer Skincare Routine for Healthy and Radiant Skin in 2023

Interesting..keep on posting..!❤️